Day trading demands the right day trading software and tools that don’t fail when market activity heats up. I’ve tested every major platform day traders use, tracking which trading tools deliver value versus which drain your brokerage account.

Most day traders lose money not from lack of skill, but from using wrong day trading tools. The right day trading software makes the difference between catching momentum and watching opportunities disappear.

Transparency: We may get compensated when you click on links in this article.

Quick Comparison: Essential Day Trading Tools

| Tool | Category | Price | Best For | Paper Trading |

|---|---|---|---|---|

| Trade Ideas | Scanner | $84/mo | Real-time scanning | Yes |

| TradingView | Charting | Free-$59.95/mo | Community charts | Yes |

| TrendSpider | Analysis | $49.95/mo | Pattern recognition | Yes |

| edgeful | Scanner | $39/mo | Momentum setups | Yes |

| TradeZella | Journal | $49/mo | Performance tracking | N/A |

| Edgewonk | Journal | €79/yr | Position sizing | N/A |

| BlackBoxStocks | Scanner | $99.97/mo | Options flow | Yes |

| TC2000 | Charting | $9.99/mo | U.S. stocks | No |

| Finviz Elite | Screener | $39.95/mo | Quick scanning | No |

| Benzinga Pro | News | $149/mo | Breaking news | No |

1. Trade Ideas: Best Real-Time Scanner for Day Trading

Price: Starting at $84/month

Trade Ideas dominates the day trading software space for real-time scanning. This is what I open first every trading day, before Interactive Brokers, before checking news, before anything else.

Holly AI and Intelligent Scanning

Holly AI is the standout feature separating Trade Ideas from basic stock scanners. This artificial intelligence generates trading ideas based on historical data and current market activity, finding setups automatically. It learns from patterns and adapts to market conditions.

The real-time scanning processes thousands of stocks instantly. You can create scans combining technical indicators, volume spikes, and price action. During the first hour when volatility peaks, this speed matters enormously.

OddsMaker and Strategy Testing

OddsMaker shows historical win rates for specific setups. If a stock gaps up 5% on high volume, OddsMaker reveals how often that pattern led to continuation. This data-driven approach helps day traders make informed decisions.

The backtesting lets you test day trading strategies using years of historical data. The paper trading accounts simulate real market conditions including slippage and realistic fills.

Real-World Usage

My morning routine: open at 8:45 AM EST, check Holly’s picks for pre-market movers, run custom scans. By market open, I have a focused watchlist of 5-10 stocks.

The platform integrates with Interactive Brokers and other online brokers, though most use it for scanning alongside TradingView for charting.

Read our Trade Ideas review for current pricing.

Pros: Fastest real-time scanning, Holly AI generates ideas automatically, OddsMaker probability data, excellent paper trading, cloud-based, broker integration

Cons: Expensive, overwhelming for new traders, requires separate charting, learning curve

Best For: Day traders making multiple trades daily who need fast market scanners to catch momentum setups.

2. TrendSpider: Best Automated Analysis for Day Trading

Price: $49.95/month (Essential plan)

TrendSpider leads for automated technical analysis. The platform uses AI to handle the tedious parts of chart work, identifying patterns, drawing trendlines, analyzing multiple time frames simultaneously. It’s like having a technical analyst working 24/7.

AI-Powered Pattern Recognition

The AI continuously monitors charts across different time frames, identifying patterns day traders seek. Head and shoulders, flags, triangles, wedges, TrendSpider spots these automatically across thousands of stocks. I was skeptical about AI pattern recognition until I used TrendSpider. It genuinely works and finds setups I would have missed scanning manually.

The multi-timeframe analysis shows up to 8 time frames with automated analysis across all of them. When day trading, confirming setups across multiple time frames improves execution quality and reduces poor entries. If a pattern looks good on the 5-minute chart but the 15-minute and 1-hour charts show resistance, TrendSpider highlights this immediately.

Backtesting and Smart Alerts

TrendSpider includes robust backtesting using years of historical data. You can test day trading strategies before deploying them in your margin account. The Strategy Tester doesn’t require coding, you can build strategies visually and see how they would have performed.

The Dynamic Price Alerts trigger based on complex setups combining multiple technical indicators. Instead of simple “alert when price hits $50” alerts, you can create conditions like “alert when RSI crosses above 30 AND price breaks above the 50-day moving average AND volume exceeds 2x average.” This specificity has caught me several high-probability entries.

The platform includes paper trading accounts, so you can test automated strategies in simulated conditions before risking real money.

Read our TrendSpider review for comprehensive feature breakdown.

Pros:

- Automated pattern recognition saves hours

- Multi-timeframe analysis improves trade quality

- Paper trading accounts included

- No coding required for strategies

- Strong technical indicators library

Cons:

- More expensive than basic tools

- Learning curve for all features

- Primarily stocks and crypto

- Limited futures trading support

Best For: Day traders who want automation without sacrificing analytical depth. If you’re spending hours drawing trendlines manually, TrendSpider pays for itself quickly.

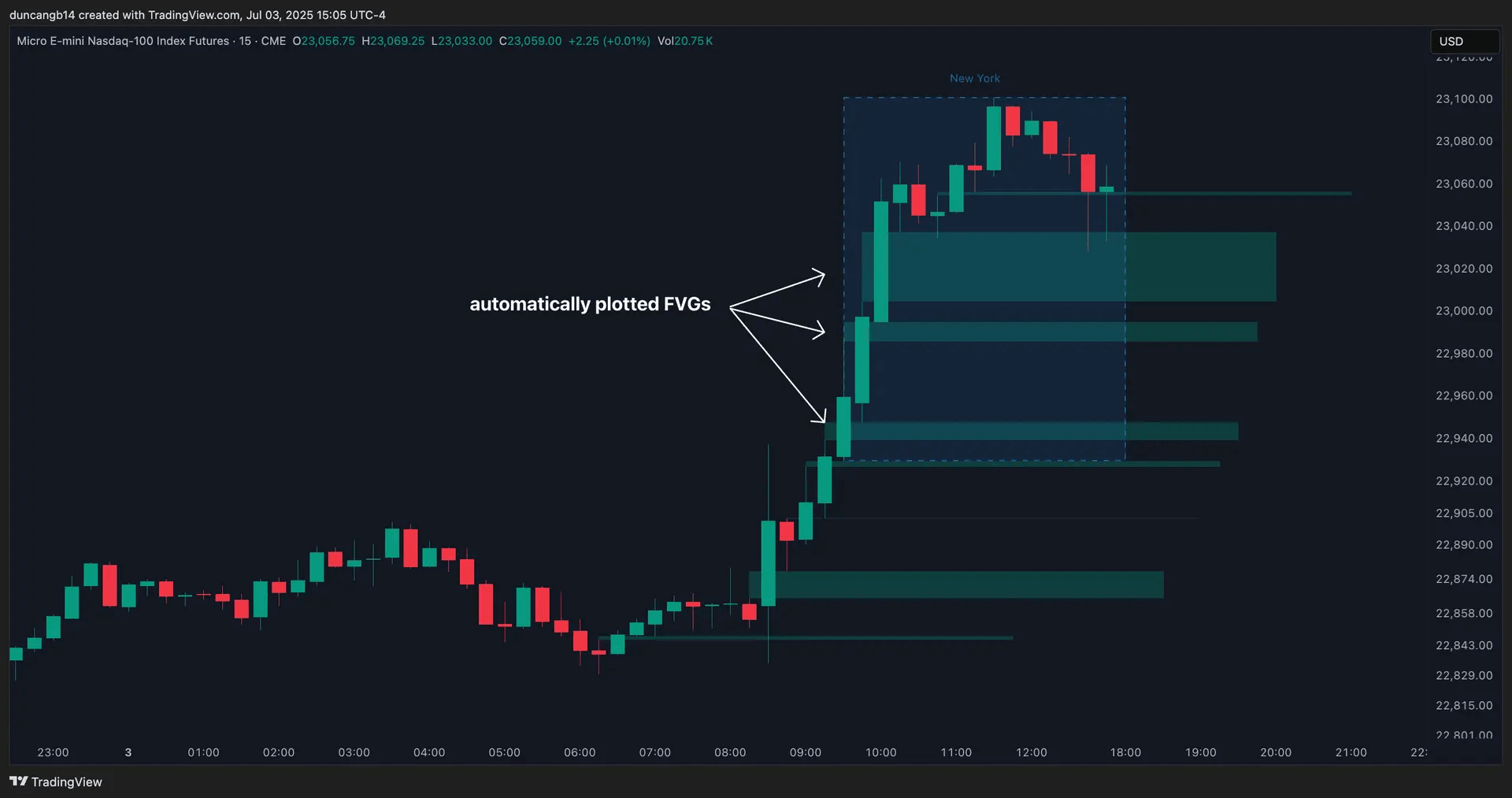

3. TradingView: Best Charting Software for Day Trading

Price: Free / Pro starts at $14.95/month

TradingView is the charting software most day traders use. It’s become the industry standard for good reason.

Professional Charting Tools

The charting capabilities rival expensive desktop platforms while running in your browser. Over 100 built-in technical indicators including moving averages, RSI, MACD, and Bollinger Bands. Drawing tools are extensive, trendlines, Fibonacci retracements, support zones, and custom shapes.

Pine Script lets you create custom indicators. The community created over 100,000 custom studies. I learned Pine Script basics in a weekend and now have indicators matching my strategies perfectly. The mobile app works smoothly for monitoring positions and setting alerts.

Paper Trading and Integration

TradingView offers paper trading accounts simulating real trading without risking real money. New day traders should spend months here before opening a margin account. The simulation includes realistic fills and slippage.

The platform connects directly with Interactive Brokers and many online brokers. You can analyze charts and execute trades from the same interface, essential for fast-moving day trading.

Community Features

The social aspect generates trading ideas. “Editor’s Picks” features technical analysis from experienced traders sharing setups and trading strategies. You can publish analysis, follow traders, and participate in discussions. The community provides valuable perspective on market activity.

Check our TradingView review for comprehensive details.

Pros: Excellent charting, works everywhere, strong community, affordable pricing, paper trading included, broker integration

Cons: Free version has ads and limits, real time data requires paid subscription, advanced features locked, can overwhelm beginners

Best For: Day traders wanting professional charting without desktop installation. The balance of features, community, and pricing makes it essential.

4. edgeful: Best Momentum Scanner for Day Trading

Price: $39/month

edgeful focuses specifically on momentum day trading strategies. This scanning software finds stocks, futures and cryptocurrencies with unusual volume spikes and other price action alerts that indicates potential breakouts. It’s built by day traders for day traders.

Real-Time Momentum Alerts

The platform sends instant alerts when stocks meet momentum criteria, things like unusual volume combined with price acceleration. For day traders focused on the first two hours of the trading day when momentum is strongest, these real-time insights help catch moves early.

The scanning logic is designed around what actually works in momentum trading. It’s not just looking for volume, it’s looking for the right kind of volume at the right time. Institutional buying looks different from retail FOMO, and edgeful tries to distinguish between them.

Paper Trading and Integration

edgeful includes solid paper trading account connections for testing strategies. New day traders should use this feature extensively before risking real money in active trading. The simulation is realistic enough to give you a sense of whether your day trading strategies work. You can monitor scans, analyze setups, and execute trades from the platform without switching between multiple windows.

Check our edgeful review for current features.

Pros:

- Focused specifically on momentum day trading

- Real-time alerts

- Paper trading possible

- Reasonable pricing

- Automated trading possible

Cons:

- New tool

- Only a few automated algos

- Limited historical data for backtesting

Best For: Day traders who trade momentum breakouts and need specialized scanning software built specifically for this strategy. If momentum is your primary approach, edgeful’s focused feature set makes sense.

5. Finviz Elite: Best Quick Scanner for Day Trading

Price: $39.95/month

Finviz Elite offers fast scanning for day trading at reasonable pricing. While not as sophisticated as Trade Ideas, it provides solid scanning software for active traders who don’t need millisecond-level real-time data.

Scanning Capabilities

Finviz Elite lets you filter stocks based on technical indicators, volume, price changes, and dozens of other criteria. The visual heat maps show market activity at a glance, incredibly useful for identifying sector rotation during the trading day. When tech is hot and healthcare is cold, you can see it immediately.

The scanning software updates frequently enough for swing trading and end-of-day analysis. For pure day trading, there’s a slight delay compared to real-time scanners like Trade Ideas. On fast-moving momentum stocks, this delay can matter. But for many day trading strategies that aren’t dependent on being first, Finviz Elite works well.

Pre-Market Preparation

I use Finviz Elite primarily for pre-market research. The “Top Gainers,” “Top Losers,” and “Most Volatile” lists help identify stocks with unusual market activity before the trading day begins. I’ll scan these lists around 8:00 AM EST, add interesting stocks to my watchlist, then switch to Trade Ideas for real-time scanning once markets open.

The platform works entirely in your browser, no installation needed. The mobile app provides access to scans and charts during the trading day, though the interface is more functional than beautiful.

Check our Finviz Elite review for more details.

Pros:

- Affordable for day trading tools

- Fast scanning and visual heat maps

- No installation required (web-based)

- Good for pre-market research

- Simple, clean interface

Cons:

- Not true real-time for day trading

- Basic charting versus dedicated charting software

- Limited to U.S. stocks only

- No paper trading accounts

Best For: Day traders on a budget who trade based on patterns rather than millisecond timing. Works well combined with TradingView for charting and more detailed technical analysis.

6. TradeZella: Best Trading Journal for Day Trading

Price: $49/month

TradeZella revolutionizes how day traders track performance. This isn’t just a simple trading journal where you log entries and exits. It’s an analytical platform that dissects your trading strategies, identifies patterns in your wins and losses, and helps improve execution quality systematically.

Performance Analytics

The platform automatically imports trades from Interactive Brokers and other major online brokers. It categorizes trades by setup type, time of day, holding period, and dozens of other factors. Then it shows you which day trading strategies actually work for you versus which ones are draining your brokerage account.

The analytics reveal insights like: which time frames produce your best trades, whether your position sizing is optimal, which setups have the highest win rate, and if certain market conditions hurt your performance. I discovered through TradeZella that I was significantly more profitable trading in the first hour versus the last hour, a pattern I hadn’t noticed manually. The TradeZella review goes into detail here.

Position Sizing Tools

TradeZella includes position sizing calculators that help day traders manage risk properly. Since investing involves risk and day trading amplifies that risk, proper position sizing prevents single trades from damaging your brokerage account significantly.

The platform shows if you’re risking too much on individual trades or if you’re being too conservative and leaving money on the table. It tracks your risk-to-reward ratios and highlights when you’re taking setups that don’t match your stated risk parameters.

Pros:

- Automatic trade importing from major brokers

- Deep performance analytics

- Position sizing optimization tools

- Easy to use interface

- Identifies weak patterns in your trading

- Helps track progress over time

Cons:

- Monthly subscription cost adds up

- Requires consistent logging for best results

- Limited broker integrations currently

- No paper trading features

Best For: Serious day traders who want to improve through data analysis. If you’re not tracking trades systematically with a proper trading journal, you’re essentially guessing about what works. TradeZella removes the guesswork.

7. Edgewonk: Best Advanced Trading Journal

Price: €79/year (approximately $85/year)

Edgewonk offers the most comprehensive trading journal for day traders who want institutional-level analytics. It’s more complex than TradeZella but provides additional insights into trading psychology, risk management, and performance patterns that casual journals miss.

Advanced Metrics and Psychology

The platform tracks everything: win rates, average wins versus losses, maximum drawdown, position sizing effectiveness, profit factor, and psychological factors affecting your day trading. The analytics help identify not just which trading strategies work, but why they work and under what conditions.

The psychology tracking is unique. You can log your emotional state before trades, note market conditions, and track how different mental states affect your performance. Many day traders lose money not because their strategy is bad, but because they deviate from it during emotional moments. Edgewonk helps identify these patterns, and like the Edgewonk review shows, in a good and affordable way.

Risk Management Analysis

Edgewonk excels at position sizing analysis. It shows whether you’re risking appropriate amounts relative to your margin account size and whether your risk-reward ratios match your stated day trading strategies. The R-multiple analysis shows your average return per unit of risk, a key metric professional traders use.

The platform requires manual trade entry, which some traders see as a disadvantage. But the manual process forces you to review each trade thoughtfully rather than just importing and forgetting.

Pros:

- Comprehensive analytics rarely found in trading journals

- Annual pricing (cheaper long-term than monthly subscriptions)

- Advanced risk metrics

- Trading psychology tracking

- Detailed reporting and visualizations

- One-time payment model

Cons:

- Steeper learning curve

- Manual trade entry required (no automatic importing)

- Interface less modern than newer tools

- Can overwhelm beginners with data

Best For: Experienced day traders who want institutional-level analytics for their trading journal. The depth justifies the learning curve if you’re serious about improvement.

8. BlackBoxStocks: Best for Options Day Trading

Price: $99.97/month

BlackBoxStocks specializes in options trading tools and unusual options activity monitoring. If you trade options alongside or instead of stocks, this platform provides unique data you won’t find in standard day trading software.

Options Flow Analysis

The key feature tracks large options trades, often called “smart money” flows. When institutional traders or hedge funds place significant options trades, it can signal upcoming moves in the underlying stocks. BlackBoxStocks monitors this activity in real-time and alerts you when unusual options activity occurs.

The platform shows the size of the trades, whether they’re bullish or bearish, and the implied expectations for price movement. Day traders use this information to identify trading opportunities or to avoid positions where institutional money is betting against them.

Real-Time Alerts and Community

BlackBoxStocks sends alerts for unusual options activity, volume spikes in stocks and options, and technical setups. For day traders who trade options alongside stocks, these real-time insights provide edge in fast markets.

The community aspect is strong. You can see what other traders are watching, discuss setups in chat rooms, and learn from experienced options traders. We discuss this in detail in the BlackBoxStocks review.

Live Trading Sessions

The platform includes live trading sessions where experienced traders share their setups during market hours. This trading education component helps new day traders learn from active traders making real trades in real-time. You see the thought process, not just the after-the-fact rationalization.

Pros:

- Unique options flow data not available elsewhere

- Live trading sessions during market hours

- Active community of day traders

- Real-time alerts for unusual activity

- Paper trading accounts for practice

- Combines stock and options scanning

Cons:

- Expensive compared to stock-only tools

- Primarily focused on options

- Requires options trading knowledge

- Feature-rich interface can overwhelm newcomers

Best For: Day traders who trade options and want visibility into institutional flow. If you don’t trade options, the specialized features aren’t worth the cost. But for options traders, the flow data alone can justify the subscription.

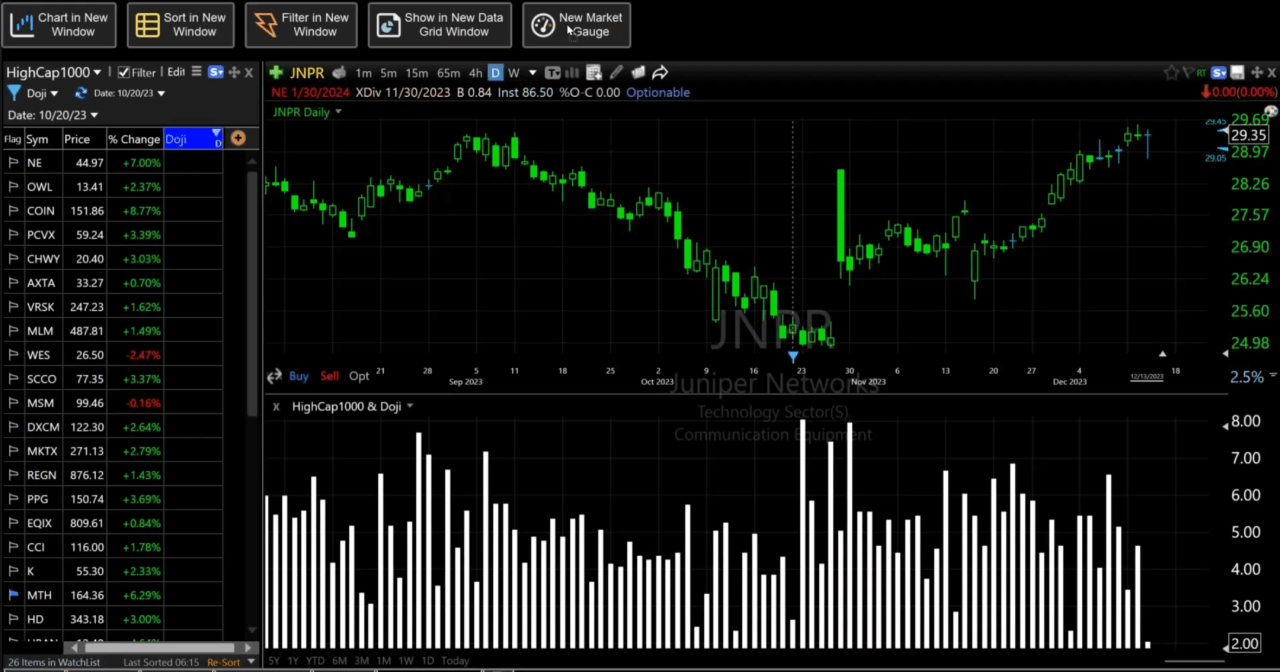

9. TC2000: Best Value Day Trading Platform

Price: $9.99/month (TC2000 Lite)

TC2000 offers exceptional value for day traders focused on U.S. stocks. At under $10/month, it provides charting software and scanning capabilities that rival platforms costing 5-10x more. It’s proof that expensive doesn’t always mean better in day trading tools.

Fast Scanning Capabilities

TC2000’s scanning software runs incredibly quickly across thousands of stocks. You can create scans combining technical indicators, price action, volume patterns, and fundamental criteria. The scans execute almost instantly, important when you’re looking for setups at market open when opportunities appear and disappear quickly.

The EasyScan feature includes pre-built scans for common day trading setups like gap-ups, momentum breakouts, volume surges, and reversal patterns. New day traders can use these immediately while learning to build custom scans for their specific trading strategies.

The relative rotation graphs show sector rotation at a glance, useful for understanding where money is flowing in the market. If tech stocks are rotating out and healthcare is rotating in, you want to know that before entering positions.

Charting and Analysis

The platform includes solid charting software with all standard technical indicators and drawing tools. While not as feature-rich as TradingView, it’s more than sufficient for most day trading strategies. The charts are clean, fast, and customizable.

TC2000 integrates with Interactive Brokers for order routing, so you can scan, analyze, and execute all from one platform. The execution quality through Interactive Brokers is excellent.

Limitations to Consider

The main limitation is TC2000 doesn’t offer paper trading accounts, a significant disadvantage for new day traders who should practice before risking real money. You’ll need to use a separate platform or your broker’s paper trading if you want to test strategies.

It’s also primarily focused on U.S. stocks. If you trade forex, futures, or international stocks, you’ll need different day trading software.

Pros:

- Extremely affordable pricing

- Fast scanning for U.S. stocks

- Good charting tools for day trading

- Broker integration with Interactive Brokers

- Low cost makes it accessible for beginners

- Clean, stable platform

Cons:

- U.S. stocks only (no forex, futures, crypto)

- No paper trading accounts

- Less versatile than TradingView

- Limited cryptocurrency coverage

- Smaller user community

Best For: Budget-conscious day traders focused exclusively on U.S. stocks who want solid scanning software without premium pricing. It’s an excellent choice for traders who don’t need international markets or the social features of platforms like TradingView. Read more about it in the review about TC2000.

10. Benzinga Pro: Best News Feed for Day Trading

Price: $149/month

Benzinga Pro provides real-time news feeds that are crucial for news-based day trading. When breaking news hits stocks, day traders need to know instantly, not 30 seconds later after the move has already happened. That speed difference is what Benzinga Pro provides.

Breaking News Speed

The platform delivers news faster than free sources like Yahoo Finance or even major financial websites. For day traders, getting news 20-30 seconds earlier can mean the difference between catching the initial move and chasing an already-extended stock.

I’ve compared Benzinga Pro’s alerts with free news sources repeatedly. Benzinga consistently delivers breaking news, especially earnings reports, FDA approvals, and corporate announcements, ahead of other sources. That edge matters in day trading.

Filtered Alerts and Watchlists

Benzinga Pro filters news by your watchlists and specific stocks you’re tracking. Instead of drinking from the firehose of all market news, you get relevant alerts for the stocks you actually care about. During earnings season or when you’re trading stocks with upcoming catalysts, these filtered alerts help you react to market activity quickly without information overload.

You can set up multiple watchlists for different trading strategies, maybe one for momentum plays, another for earnings trades, another for swing positions. Each gets its own customized news stream.

Social Sentiment Tracking

The platform tracks social media mentions and sentiment around stocks. When retail activity surges around specific stocks, think of meme stock scenarios, day traders can identify potential volatility and trading opportunities before the moves happen.

The sentiment indicators aren’t perfect, but they provide useful context. If a stock you’re considering is seeing unusually high negative sentiment on social media, you might want to avoid it or adjust your position sizing.

Mobile Alerts

The mobile app ensures you don’t miss important news even when away from your desk. The push notifications are fast and customizable, you can set different alert levels for different types of news.

Read our Benzinga Pro review for detailed analysis.

Pros:

- Fastest breaking news delivery

- Filtered by watchlists (reduces noise)

- Social sentiment tracking

- Integration with trading platforms

- Excellent mobile app for alerts

- Audio squawk provides news without reading

Cons:

- Expensive for a single-purpose tool

- News-focused only (no charting or scanning)

- Monthly subscription required (no annual discount)

- Overkill if you don’t trade news-driven moves

Best For: Active day traders who trade news-driven moves and need information edge. The cost makes sense if news trading is your primary or a significant secondary strategy. If you rarely trade based on breaking news, stick with free news sources and invest in better scanning or charting software instead.

Essential Day Trading Setup

Beyond day trading software, your complete setup matters:

Hardware: Reliable computer, stable internet, dual monitors recommended, mobile app for monitoring

Brokerage: Low commissions with good execution quality. Interactive Brokers offers excellent service. Consider whether many brokers use payment for order flow.

Capital: Pattern Day Trader rule requires minimum equity of $25,000 in margin account for 4+ day trades per 5 trading days. Paper trading accounts let you practice without this requirement.

Day Trading Strategy Essentials

Position Sizing: Risk only 1-2% per trade. Tools like TradeZella help optimize this.

Trading Day Structure: Focus on first 90 minutes after open and final 30 minutes before close.

Risk Disclosure: Investing involves risk. Day trading amplifies it. Most day traders lose money initially. Before risking real money: use paper trading accounts for months, test strategies with historical data, understand margin trading multiplies gains and losses, never trade money you can’t afford to lose.

Choosing Day Trading Tools by Trading Style

New Day Traders: TradingView free + Finviz. Practice 3-6 months in paper trading before risking real money.

Active Day Traders: Trade Ideas ($84/mo) + TradingView Pro ($14.95/mo) + TradeZella ($49/mo). ~$150/month justified for multiple daily trades.

Options Traders: BlackBoxStocks ($99.97/mo) + TradingView for options flow visibility.

Budget Traders: TC2000 ($9.99/mo). Use paper trading until profitable.

News Traders: Benzinga Pro ($149/mo) + basic charting.

Common Day Trading Mistakes

Too Many Tools: Start with scanner, charting, and journal. Add specialized tools only after identifying specific needs.

Skipping Paper Trading: Spend 3+ months in paper trading accounts before risking real money. If unprofitable with simulated trades, you won’t profit with real money.

Poor Position Sizing: Risk only 1-2% per trade. Poor position sizing destroys accounts even with excellent day trading strategies.

No Trading Plan: Enter each trading day knowing which stocks to watch, what setups to find, and how much to risk.

Day Trading FAQ

What is the best tool for day trading?

Trade Ideas is the best tool if choosing only one, real-time scanning helps day traders find opportunities as they develop. However, most successful day traders use multiple tools: Trade Ideas for scanning, TradingView for charting, and a trading journal. The “best” depends on your day trading strategies, news traders might prioritize Benzinga Pro, options traders BlackBoxStocks.

Is $100 enough for day trading?

No. The Pattern Day Trader rule requires minimum equity of $25,000 in your margin account for making more than 3 day trades within 5 trading days. With $100, focus on paper trading accounts to practice while building capital. Most day traders lose money initially.

Can I make $1000 per day from trading?

Possible but requires substantial capital ($100,000-$250,000) and carries high risk. Most day traders lose money, especially starting. Even experienced traders have losing days. Focus on consistent profitability with smaller amounts through paper trading before attempting large daily goals. Investing involves risk, margin trading amplifies gains and losses.

Why is $25,000 required to day trade?

FINRA’s Pattern Day Trader rule requires this minimum equity from all U.S. broker dealers to protect retail traders from day trading’s high risks. Day trading involves frequent trades using margin account leverage, where traders can lose money quickly. The $25,000 ensures sufficient buying power to absorb losses. Making 4+ day trades within 5 trading days classifies you as pattern day trader requiring this minimum.

Final Thoughts

The right day trading software matters, but tools amplify skill, they don’t replace it. After testing these day trading platforms extensively, my essential setup includes Trade Ideas ($84/mo), TradingView Pro ($14.95/mo), TradeZella ($49/mo), and Benzinga Pro ($149/mo). Total: ~$297/month, justified when a single avoided bad trade pays for it.

Progressive approach:

Months 1-3: Free tools only. TradingView free for charts, Finviz for scanning. Don’t risk real money. Use paper trading accounts to test day trading strategies. Learn technical indicators like moving averages, practice with drawing tools, and get comfortable before adding complexity. Most day traders who skip this lose money quickly.

Months 4-6: If profitable in paper trading, upgrade to TradingView Pro ($14.95/mo) for real time market data. Continue paper trading but with accurate data matching live markets. Research broker dealers and their transaction costs. Understand margin trading and buying power calculations, but don’t use leverage yet.

Months 7-12: Once consistently profitable, open a brokerage account meeting minimum equity requirement. Add Trade Ideas ($84/mo) and trading journal. Start small, risk only 0.5% per trade initially. This helps adjust to real emotions. Even profitable paper traders struggle initially because risking real money creates psychological pressure.

Year 2+: Add specialized tools based on proven day trading strategies. News traders add Benzinga Pro. Options traders add BlackBoxStocks. Only add tools after identifying specific needs.

Key reminders:

Choose the right brokerage account. Interactive Brokers consistently ranks high for execution quality and low transaction costs. Many brokers offer commission-free trading but earn through payment for order flow, which can affect fills.

For margin trading, understand that 4:1 buying power amplifies both gains and losses. Use only a fraction of available leverage. Most successful day traders use 20-40% of their buying power, not 100%.

If expanding to options trades or futures trading, prove profitability in stocks first. Each financial instrument requires adjusted day trading strategies.

Remember: the best day trading tools help active traders execute strategies more efficiently. They don’t create strategies or guarantee profits. Investing involves risk, and day trading amplifies those risks through frequent trades and margin account leverage.

Focus on developing sound day trading strategies using paper trading accounts first. Then let the right day trading software help execute those strategies in real markets. The trading tools should serve your strategy, not the other way around.

For more resources, check our guides on stock scanners, stock analysis software, and charting software.